Stock option valuation calculator

Please enter your option information below to see your potential savings. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

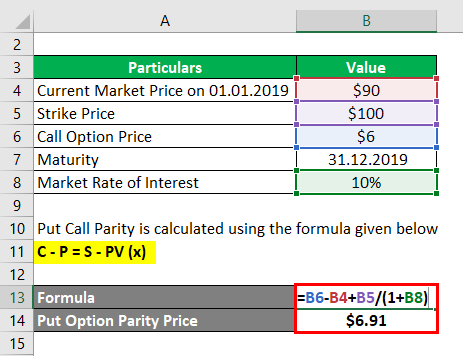

Put Call Parity Formula How To Calculate Put Call Parity

Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

. Options Warrants Calculator Downloads Download User Guide The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price. However if you own a set. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Ad Instant access to real-time and historical options market data. On this page is a non-qualified stock option or NSO calculator. We develop a valuation model for venture capital--backed companies and apply it to 135 US unicorns that is private companies with reported valuations above 1 billion.

Option trading is a highly rewarding way to supercharge your returns. Black-Scholes Calculator To calculate a basic Black-Scholes value for your stock options fill in the fields below. Your ownership form SharesRSU Options Number of.

My startup stock options calculator Real Finance Guy RFG Stock Option ISO Value Estimator Number of Shares in Grant Current Value Per Share Total Number of Shares. Colorful interactive simply The Best Financial Calculators. This is a simple calculator to estimate the value of your options assuming a range of valuations and growth rates that may or may not happen.

Perhaps youve read about the Black-Scholes Model but wonder where it comes into play in the world of options trading. Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal. Get a branded for your website.

It does not include factors like the liquidation. Enter your company name or stock ticker below and and click Load data and we will value your shares or options using Finnhub data. An asset manager since 1989 Carmignac can help.

This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies. Ad Online Valuation Calculation in less than 1 Hour. Seize investment opportunities with the help of our experts.

Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20 Days. For this calculator the current stock price is assumed to be the. The general approach is to calculate the fair value using one of the methods described below and then time value is the difference between fair value and intrinsic value.

Option value calculator Calculate your options value. Including trades quotes aggregates and reference data. Stock Options Final Year Values After 15 years at 7 options are worth 138 Definitions Current stock price Current stock price.

Ad Planning to invest. The data and results will not be saved and do not feed the tools on this. Free connection to market data - automatically calculates historical volatility Calculate a multi-dimensional analysis The below calculator will calculate the fair market price the Greeks and.

Know how much your company is worth. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. This calculator illustrates the tax benefits of exercising your stock options before IPO.

On this page is an Incentive Stock Options or ISO calculator. Years until option expiration date 0 to 20 Total number. Calculate Fair Values of Call options and Put options for Nifty Options and a wide range of other Index and Stock options.

Receiving options for your companys stock can be an incredible benefit. Valuation Price x Total Number of Shares Valuations of a company can increase from both price increases and increasing the number of shares of a company. The options calculator is an intuitive and easy-to-use.

Options involve risk and are not suitable for all investors.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

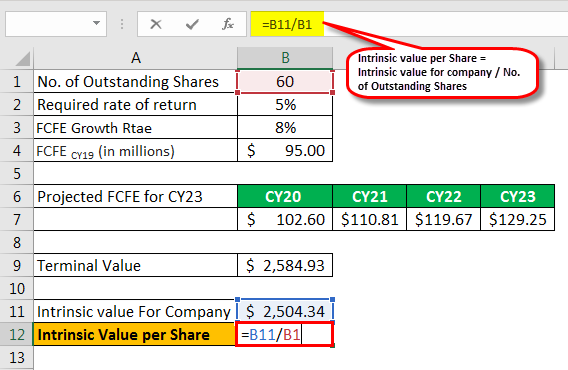

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How Is Total Stock Compensation Expense Calculated Universal Cpa Review

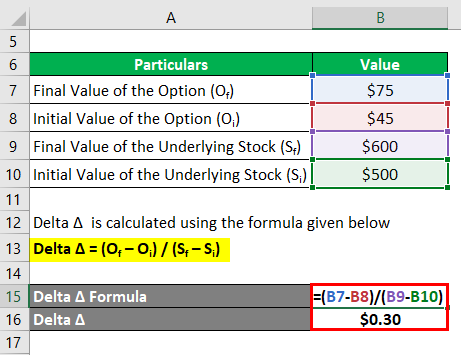

Delta Formula Calculator Examples With Excel Template

Treasury Stock Method Tsm Formula And Excel Calculator

Intrinsic Value Formula Example How To Calculate Intrinsic Value Intrinsic Value Intrinsic Company Values

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

Treasury Stock Method Tsm Formula And Excel Calculator

What Is The Intrinsic Value Formula Try This Online Calculator Ben Graham Getmoneyrich

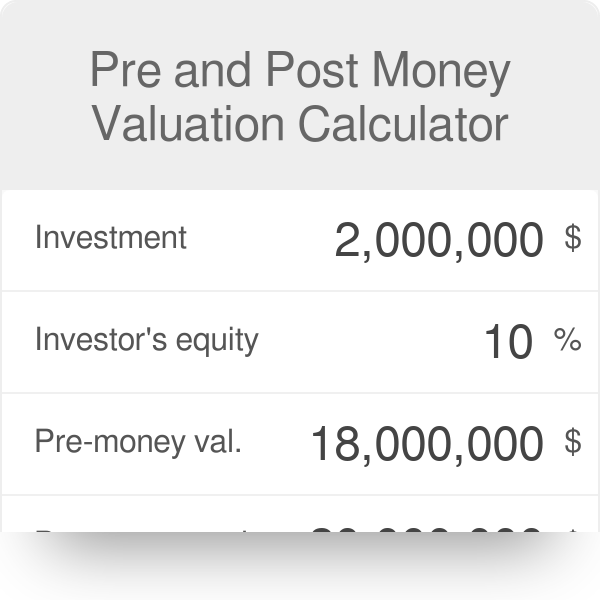

Startup Valuation Calculator Investment Equity Post And Pre Money

Treasury Stock Method Tsm Formula And Excel Calculator

Stock Total Return And Dividend Calculator

Call Option Calculator Put Option

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation