Credit card borrowing capacity

192 views 6 likes 0 loves 0 comments 3 shares Facebook Watch Videos from Switch Finance. Find out what your borrowing capacity could look like and how a credit card can affect this.

Credit Card Capital One Citi Other Banks Cut 99 Billion From Spending Limits Bloomberg

680 views 23 likes 5 loves 6 comments 0 shares Facebook Watch Videos from Up Loans.

. Lenders assess based on the credit card limit NOT on what you owe. Credit history employment history. Did you know a 10000 credit card could reduce your borrowing capacity by as much as 50000 - even if you never use the cardIn the eyes of many banks tod.

Permanent residents must earn at least 25000 pa. When you apply for credit the lender will assess your whole. Your borrowing capacity sometimes referred to as borrowing power is the amount of money a credit provider can lend to you.

A credit card limit of 40000 can reduce your borrowing capacity by 160000 4 x the credit limit. For example if you. When applying for a home loan having multiple credit cards might put you at a disadvantage.

As a potential homebuyer your credit. In Dec 2018 the total value of card transactions was c 295 billion and balances were at c 52 billion or approx. Credit Cards Borrowing Capacity.

So speak to your mortgage broker before applying for a loan. Credit card limits affect borrowing capacity on roughly a 15 ratio. It is treated as another loan or commitment which needs servicing.

Start date 11th Oct 2003. With credit cards though this often is not the case and if one already has a limit of 20000 and adds another 10000 of credit card borrowing capacity at a similar high rate theres more risk. Also cards with high limits is.

And this takes away from your. If you own three credit cards with a limit of 15000 each the lender could. Ever wondered why it matters what your credit card limit is if you pay the whole balance off in full.

For further details see here. Whats my borrowing capacity. For the Virgin Money No Annual Fee Card 35000 pa.

34 of credit limits available. Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie. Pre-credit crunch the amount you could borrow as a mortgage was largely defined as a multiple of your annual salary.

Lenders will consider any credit cards to be drawn to their full limit even if you have never exceeded the allocated credit limit or found yourself behind repayments. 03 9877 3000. For the Virgin Money Low Rate Card and Virgin Australia Velocity Flyer Card or.

While it is true that credit cards can help you build your credit score there are some factors about your credit card that might be your downfall when its time for you to apply. 30k in cards reduces how much you can borrow by about 150k.

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

Increasing Credit Limit On Your Corporate Credit Card

Credit Card Vs Personal Loan Which One Is A Better Option Finance Buddha Blog Enlighten Your Finances

Credit Card Payoff Calculator Credit Card Debt Paying Off Ideas Of Credit Card Debt Pa Credit Card Payoff Plan Paying Off Credit Cards Credit Card Interest

What Is A Credit Utilization Rate Experian

How To Effectively Manage Pay Off Credit Card Debt

Us Credit Card Market Share Facts And Statistics Fortunly

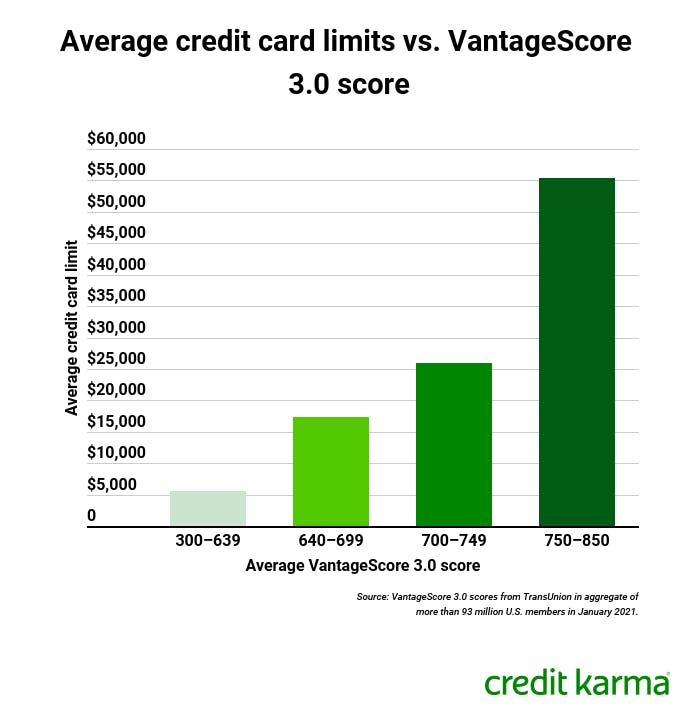

What Is A Credit Limit And How Is It Determined Credit Karma

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

Credit Card Definition

/credit-cards-Adam-Gault-OJO-ImagesGetty-Images-56a906ee3df78cf772a2f137.jpg)

Credit Card Definition

Can You Transfer Credit Limits Between Credit Cards Experian

How To Get A Credit Card With A High Limit In 2022

Credit Card Interest Calculator Find Your Payoff Date Total Interest

Faq Capital On Tap

How Much Credit Should I Have And Does It Impact My Credit Score Forbes Advisor

Credit Cards Vs Short Term Loan Which One Can Be A Good Bet Mint

How To Get Collections Off Credit Report Revealed Revealed How To Get Col Paying Credit Repair Companies Best Credit Repair Companies Credit Repair Letters